Demand market insights, dynamics and opportunities

The computing continuum, encompassing Cloud, Edge, and IoT (Internet of Things), represents a seamless integration of computing resources across various layers, from centralized cloud data centers to decentralized edge devices and IoT sensors. This structure allows data to be processed closer to the source, enabling real-time analytics, reducing latency, and enhancing data security.

The computing continuum, encompassing Cloud, Edge, and IoT (Internet of Things), represents a seamless integration of computing resources across various layers, from centralized cloud data centers to decentralized edge devices and IoT sensors. This structure allows data to be processed closer to the source, enabling real-time analytics, reducing latency, and enhancing data security.

CEI solutions are comprised of many technology components. They require devices that include some amount of computing capabilities, as well as sensors that collect data from the physical world. Depending on requirements and resource availability, the device may analyse the data before sending it over a network connection to another device (a gateway or edge node). In some cases, the data may go straight to the cloud for analysis and storage, while in other cases, edge computing resources may be located closer to the device, potentially running applications, using analytical models, automating decisions and controlling actuators on remote devices. [1]

In the last few years, the market has started the adoption of cloud and IoT technologies and lately an adoption trend towards edge computing can be observed. Indeed, the European market for technologies and solutions in the cloud-edge-IoT computing continuum is emerging strongly. IDC estimates that European spending on CEI in 2024 will amount to hundreds of billions of euros, and the market will continue to grow at a double-digit growth rate to 2028. The overall spending forecast in CEI market in 2024 is around 385 bullion Euro with IoT holding the biggest part of spending of 209 billion Euro. The forecasts show a promising increase of edge computing spending with a compound annual growth rate of 14.1% to 2028 expecting the overall spending in edge to reach to 66.6 billion Euro[2].

While many CEI use cases operate effectively with just IoT devices and centralized cloud computing to do the processing and analysis; CEI has the potential to enable much more advanced use cases, such as automation of machinery, where there is a need to incorporate edge computing close to the sensors and machinery. When vehicles, machinery or other industrial systems will be automated, the data must be analysed in real time to activate control systems. Moreover, far greater volumes of data may be needed, such as several cameras that require video analytics, which may not be easily transported over the network or might incur exorbitant costs to do so. Thus, such solutions tend to utilize significant computing resources either on the device (such as on-board a vehicle) or elsewhere nearby at the edge of the network.

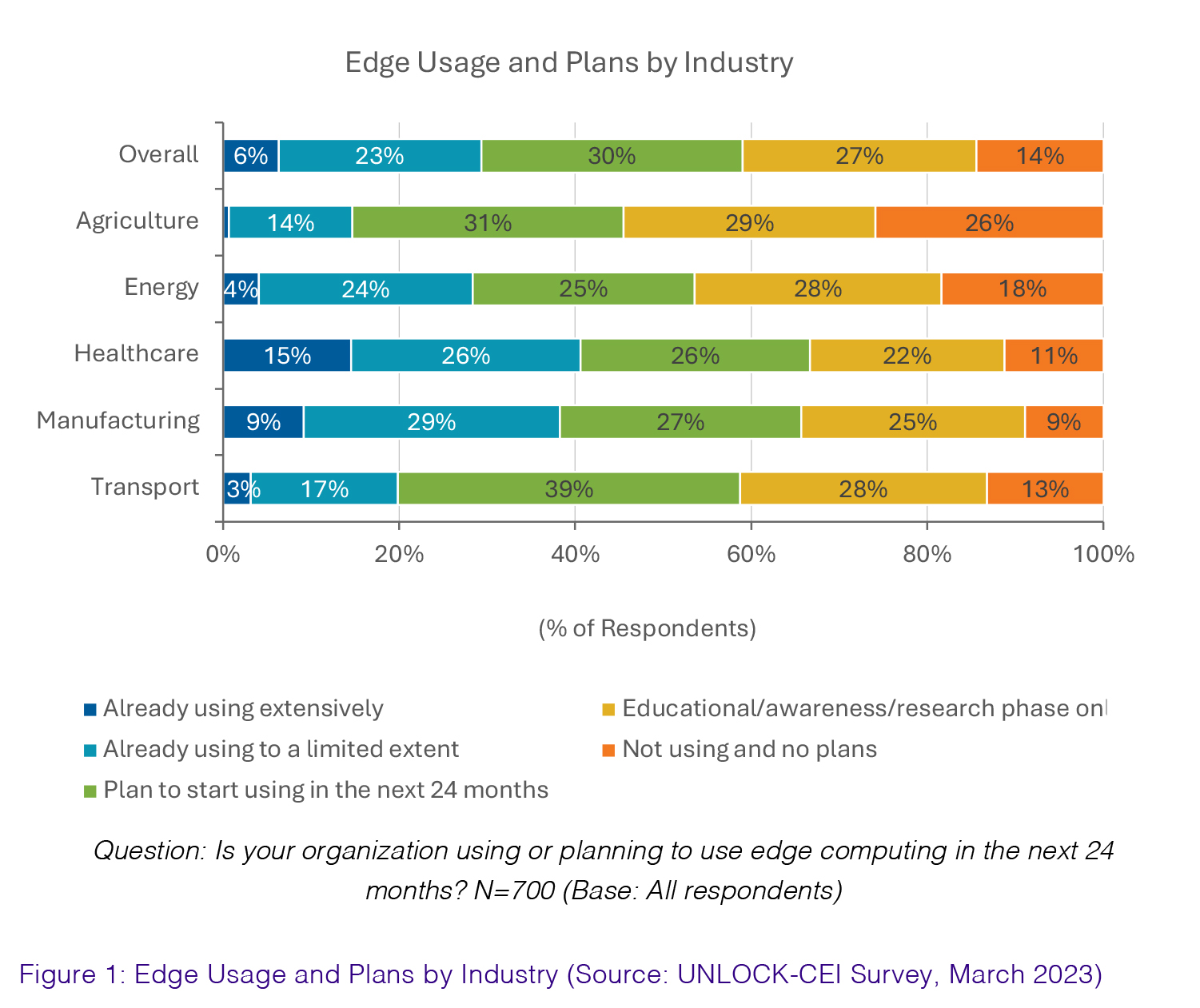

The results of a survey by Unlock-CEI project (part of EUCloudEdgeIoT initiative[3]) show that the current level of adoption of edge computing across sectors is lower than it is for cloud and IoT, with only 6% of respondents using it extensively. A larger share (23%) is, however, using it to a limited extent, and 30% of respondents said they plan to begin using it within the next 24 months. Thus, although edge is a newer category with lower adoption thus far, the market is quite interested in the technology and persuaded that it will need to deploy the technology in the future. These results suggest we can expect rapid adoption of edge computing over the next few years, though from past experience with such surveys, the share of companies claiming they plan to move ahead with investments in the future tends to overstate actual results.

Intriguingly, there are significant differences in edge adoption among the different industries. The healthcare sector leads in reported adoption, followed by manufacturing. Agriculture lags the other industries. Yet a large share of all five industries anticipates a need to deploy edge in the future.

Question: Is your organization using or planning to use edge computing in the next 24 months?

N=700 (Base: All respondents)

Figure xx Edge Usage and Plans by Industry (Source: UNLOCK-CEI Survey, March 2023)

Companies are embracing the CEI continuum for a variety of reasons. Overall, the top benefit of edge cited by respondents was that it improves security and compliance, because data is not travelling across the network. Organizations can keep tighter control over their data by keeping it close. Reducing volumes of data sent across the network was the second benefit mentioned. Reducing data sent over the network has the benefits of reducing security risk (as noted in the top response), but it also can reduce network costs and storage costs, as well as potentially freeing the organization (as noted in the third-most common response) from concerns about network availability and reliability.

The top perceived benefits of edge differ across industries. In agriculture, they are mostly network-related, such as overcoming unreliable connectivity and reducing volume of data sent across the network. In energy, and transportation, the top concerns are about security. Manufacturers balance several benefits, while being the industry with the greatest interest in deploying AI analytics models. And in healthcare, the many benefits are ranked roughly evenly, but healthcare was the industry paying the closest attention to edge’s ability to reduce costs.

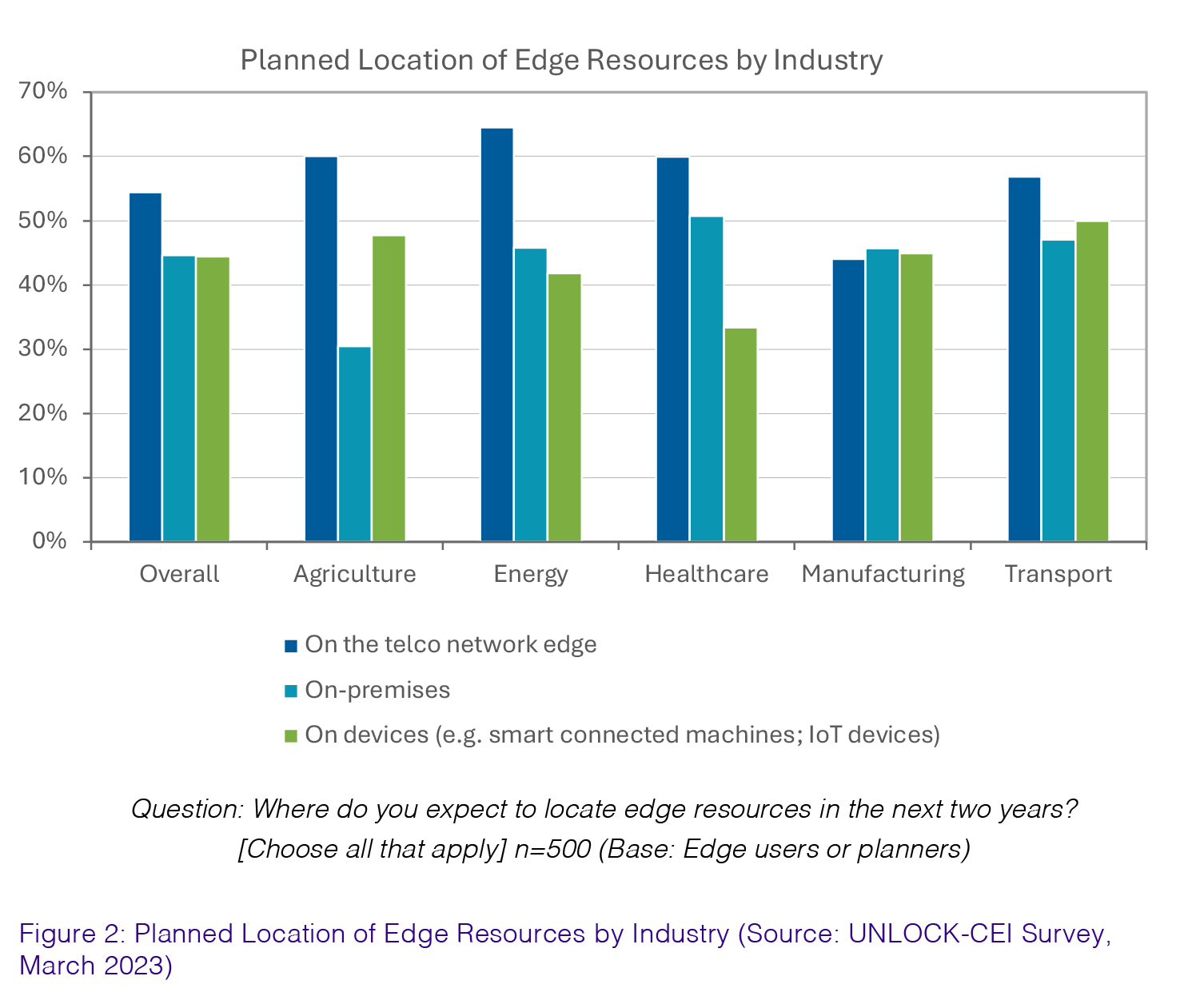

The choice of location of workload storage and analysis across the computing continuum depends upon specific requirements of each use-case and different benefits that the distribution of workloads in different locations of the continuum can bring forward. In practice, most use cases will require some combination of edge and cloud computing to handle various functions, and the amount of edge or cloud differs by use case.

Some use cases, such as those that are mobile and in remote locations, will require some compute on the device, with those devices connecting back to the cloud for aggregation and analysis. For example, surveillance cameras may utilize compute on the device for image analysis to determine which data to send across the network. Similarly, autonomous vehicles will require significant processing power and analytics on the vehicle for real-time analysis and response, while still pushing large amounts of data back to the cloud for analysis. In other cases, such as in industrial operations and manufacturing, use cases can utilize edge computing close to or on-board the machinery to monitor, analyze and control systems, while still using cloud resources for other functions. This distribution of computing resources is reflected in survey results from the UNLOCK-CEI project, which showed that even within the edge resources, companies anticipated that resources would be located in multiple places, including being on-board the smart connected equipment, in nearby on-premises locations, or on the telco edge (see figure xx)

Question: Where do you expect to locate edge resources in the next two years? [Choose all that apply]

n=500 (Base: Edge users or planners)

Figure xx Planned Location of Edge Resources by Industry (Source: UNLOCK-CEI Survey, March 2023)

The overall impression is that there is a shift towards distributing the workload across the edge-cloud continuum in upcoming years. By distributing computing resources across the continuum, companies must contend with new challenges orchestrating the data, applications and analytics across those resources.

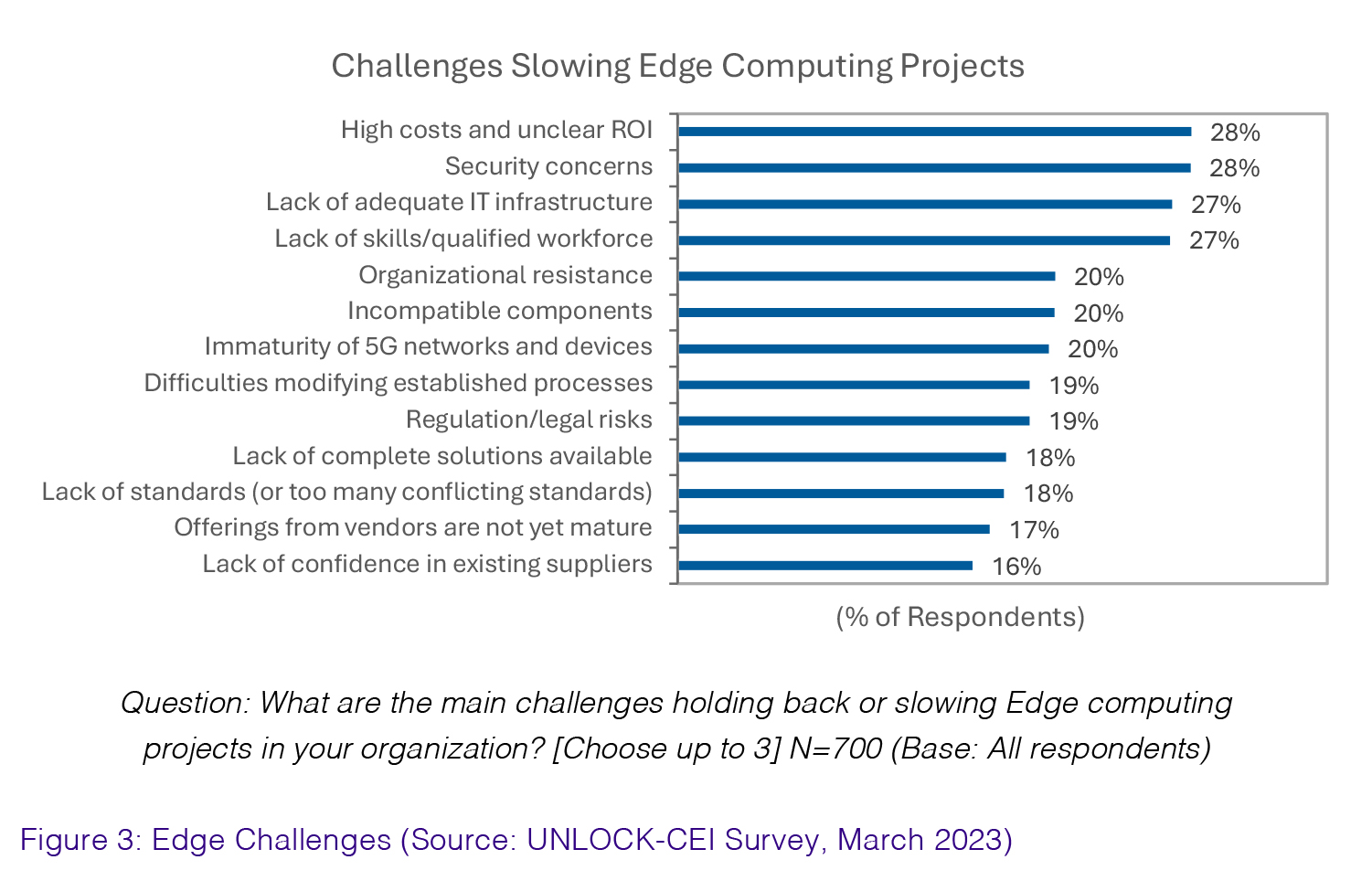

Despite the expected shift towards edge, there are still several challenges that hold back CEI adoption. The market is fragmented into many individual sub-markets, each addressing different use cases that have unique requirements, architectures and components. As a result, all of the individual use-case sub-markets are developing in parallel, greatly increasing the scale of the innovation that is required. Moreover, many of the use cases are evolving quickly to incorporate the latest technologies, such as 5G and AI, requiring still more research, development and investment.

As a result of this fragmented market that is living on the cutting edge at the intersection of many emergent technologies, CEI remains immature, and many solutions are very complex. That complexity is one of the greatest challenges holding back CEI adoption. It slows projects down, increases their costs and introduces new security vulnerabilities and requires many new skills.

Edge computing is a part of the larger CEI solution, but it presents its own key challenges that companies claim are holding back or slowing their edge computing projects. There are four top challenges that stand out: high costs and unclear ROI; security concerns; lack of adequate IT infrastructure and lack of adequate skills. These challenges are even more problematic for SMEs due to their limited resources for the adoption both from financial, technological and workforce perspectives. Indeed a comparison of the adoption of edge solutions across European companies highlights that only 15% of companies with 10 to 499 employees are currently using edge to a limited extent compared to 60% in companies with 500 to 1000+ employees.

Question: What are the main challenges holding back or slowing Edge computing projects in your organization? [Choose up to 3]

N=700 (Base: All respondents)

Figure xx Edge Challenges (Source: UNLOCK-CEI Survey, March 2023)

Another important issue to consider about moving towards edge is the important role of key complementary technologies that will be deployed on top of the computing continuum. CEI solutions are emerging within the wider context of rapid technology innovation. They incorporate a wide range of other technologies, as appropriate for the individual use case.

In the survey, 5G was the most commonly-cited technology that plays an important role in CEI plans. Big data and analytics is another important technology category to indicate. Big data requires significant strategies and tools to manage the data from CEI solutions, analyse it, and make use of it. For several years, data management has leveraged a mix of classical analytics and (increasingly) artificial intelligence. Analytics and AI are required for a wide range of purposes, including pre-processing of data to reduce the volumes of data sent over the network, enabling computer vision, enabling real-time analysisand automating systems. Many use cases will require AI models be deployed at the edge. By bringing AI capabilities to the edge, devices can analyze and act on data locally, reducing the need for continuous cloud connectivity and minimizing latency. This is especially valuable for time-sensitive applications like autonomous vehicles, industrial automation, and healthcare monitoring, where real-time insights are critical. AI at the edge also enhances data privacy, as sensitive information can be processed and filtered on-site without being sent to centralized servers.In summary, to enable Europe’s economies to fully benefit from the CEI continuum, a significant amount of innovation, standardization, skills development and investment will be required. Some of the areas requiring work include:

- Edge technologies, including edge management and orchestration tools, edge standards, and edge platforms for OEMs

- AI development, including data management and synthesis, model training and AI management across distributed edge infrastructure

- Skills development across the continuum and the many related technologies, such as edge, AI, 5G, robotics, etc.

- Standards development and harmonization across the many technology areas, including edge software, AI, and individual use cases

- Network innovation, including 5G SA deployments, network slicing, RedCap, ultra-low latency, private 5G, and Low Earth Orbiting (LEO) Non-Terrestrial Networks (NTN)

- Aid in commercializing and scaling CEI solution and technology businesses, making solutions efficient, repeatable and accessible to European enterprises and SMEs.

The CEI continuum will be a critical part of European infrastructure enabling the EU’s competitiveness in the next several years. It is a challenging, fragmented field, requiring parallel development of a wide range of technologies and solutions serving the unique needs of many different industries and use cases. As such, it cannot be solved by a single company and solution, but rather it requires a robust dynamic ecosystem of companies, researchers, standards bodies, policy-makers and other stakeholders to collaborate and drive innovation.

Such a dynamic ecosystem is something that suits Europe’s strengths in technology, education and policy. Taking the lead in CEI technologies requires Europe to put in significant work across the ecosystem including some aggressive competitiveness and entrepreneurship, as well as standards development, open-source software and supportive policies. Yet the huge interest in CEI solutions, large spending levels, and clear need for innovation present significant opportunities for European companies to take the lead and establish strong new lines of business serving the CEI market.

[1] https://zenodo.org/records/7821363

[2] IDC’s Worldwide Cloud, Edge and IoT Spending Guides, May 2024

Leave a Reply